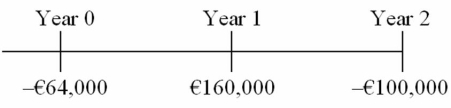

Consider the following international investment opportunity. It involves a gold mine that can be opened at a cost, then produces a positive cash flow, but then requires environmental clean up:  The current exchange rate is $1.60 = €1.00. The inflation rate in the U.S. is 6 percent and in the euro zone 2 percent. The appropriate cost of capital to a U.S.-based firm for a domestic project of this risk is 8 percent.

The current exchange rate is $1.60 = €1.00. The inflation rate in the U.S. is 6 percent and in the euro zone 2 percent. The appropriate cost of capital to a U.S.-based firm for a domestic project of this risk is 8 percent.

-Find the euro-zone cost of capital to compute the dollar-denominated NPV of this project.

Correct Answer:

Verified

Q53: As of today, the spot exchange rate

Q59: The "incremental" cash flows of a capital

Q67: What is the euro-denominated IRR of this

Q68: Find the dollar cash flows to compute

Q70: What is the dollar-denominated IRR of this

Q70: What is the dollar-denominated IRR of this

Q73: What is CF5 in dollars?

Q75: Find the dollar cash flows to compute

Q79: Repeat the above project analysis assuming that

Q89: Find the IRR in euro for the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents