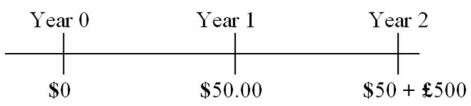

Find the value today of a 2-year dual currency bond with annual coupons (paid in U.S.dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity.The cash flows of the bond are:

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is $ = 2% in the U.S.and £ = 3% in the U.K.

A) $927.62

B) $941.30

C) $965.06

D) $599.00

Correct Answer:

Verified

Q61: A five-year, 4 percent Euroyen bond sells

Q64: Zero-coupon bonds issued in 2006 are due

Q65: A 2-year, 4 percent euro denominated bond

Q66: Consider a British pound-U.S. dollar dual currency

Q69: When the bond sells at par, the

Q70: A five-year, 4 percent euro denominated bond

Q72: Consider an 8.5 percent Swiss franc/U.S. dollar

Q73: "Investment grade" ratings are in the following

Q77: A 1-year, 4 percent euro denominated bond

Q79: With regard to dual-currency bonds versus comparable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents