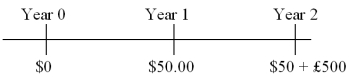

Find the value today of a 2-year dual currency bond with annual coupons (paid in U.S.dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity.The cash flows of the bond are:  The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; the pound-based yield to maturity is i£ = 4%.

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; the pound-based yield to maturity is i£ = 4%.

A) $927.77

B) $941.30

C) $965.06

D) $880.65

Correct Answer:

Verified

Q63: Standard & Poor's has for years provided

Q64: Zero-coupon bonds issued in 2006 are due

Q68: A 1-year, 4 percent pound denominated bond

Q71: Assuming that the bond sells at par,

Q75: Find the value of a three-year

Q75: Zero coupon bonds

A)have no interest income.

B)are sold

Q76: U.S. citizens must pay tax on the

Q84: The credit rating of an international borrower

A)depends

Q89: Suppose your firm needs to raise €100,000,000

Q96: Eurobond market makers and dealers are members

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents