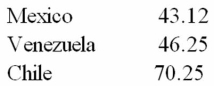

On September 10,1990 the published prices (cents on the dollar) on Latin American bank debt was quoted as follows:  Assume that the central banks of Mexico,Venezuela,and Chile redeemed their debts at 50 percent,85 percent,and 76 percent,respectively,of face value in a debt-for-equity swap.If the three countries had equal political risk,based purely on financial considerations,the cost of a $40,000,000 assembly plant investment in local currency would be ranked (lowest to highest) in dollar cost as follows:

Assume that the central banks of Mexico,Venezuela,and Chile redeemed their debts at 50 percent,85 percent,and 76 percent,respectively,of face value in a debt-for-equity swap.If the three countries had equal political risk,based purely on financial considerations,the cost of a $40,000,000 assembly plant investment in local currency would be ranked (lowest to highest) in dollar cost as follows:

A) Venezuela first, Mexico second, Chile third

B) Venezuela first, Chile second, Mexico third

C) Chile first, Venezuela second, Mexico third

D) Mexico first, Chile second, Venezuela third

Correct Answer:

Verified

Q78: Eurocredits

A)are credit cards that work in the

Q79: Teltrex International can borrow $3,000,000 at LIBOR

Q80: ABC International has borrowed $4,000,000 at LIBOR

Q81: The most widely used futures contract for

Q84: One enduring truth of banking is that

A)for

Q88: The Asian crisis

A)followed a period of economic

Q91: Proceeding the Asian crisis

A)it may have been

Q92: Who benefits from debt-for-equity swaps?

A)The creditor bank

B)The

Q94: Many lessons should be learned from the

Q95: Proceeding the Asian crisis,

A)bankers from industrialized countries

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents