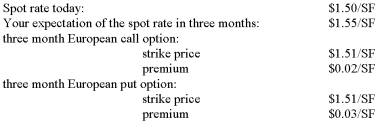

Given the following information:  If your expectations prove correct at maturity:

If your expectations prove correct at maturity:

a)What would be your profit per Swiss franc from speculating in the options market?

Show the strategy that would give the highest payoff given your expectation about the future exchange rate.

b)Graphically illustrate the loss and profit positions for the speculation in the options market.Label your graph clearly.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: The following Eurodollar futures contract is

Q12: Today's settlement price on a Chicago Mercantile

Q16: Today's settlement price on a Chicago Mercantile

Q17: In reference to the derivatives market,a "speculator"

A)attempts

Q18: Which of the following statements is true?

A)The

Q21: The value of a European call will

Q23: Today's settlement price on a Chicago Mercantile

Q24: Given the following information: Q25: Today's settlement price on a Chicago Mercantile Q26: Assume that the spot Euro is $1.2000![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents