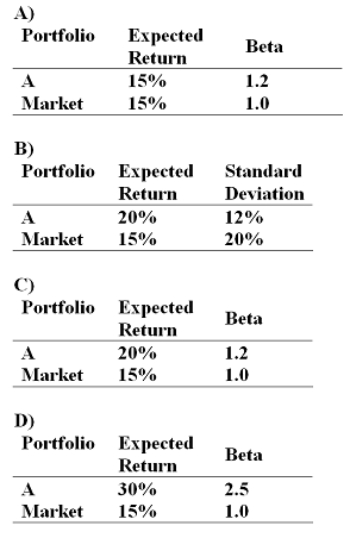

If the simple CAPM is valid and all portfolios are priced correctly, which of the situations below are possible?

Consider each situation independently and assume the risk-free rate is 5%.

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q47: According to the CAPM, what is the

Q48: The expected return on the market portfolio

Q49: There are two independent economic factors M1

Q51: You consider buying a share at a

Q53: The risk premium for exposure to exchange

Q54: According to the CAPM, what is the

Q55: Research has identified two systematic factors that

Q56: The risk premium for exposure to aluminum

Q57: Using the index model, the alpha of

Q81: The measure of risk used in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents