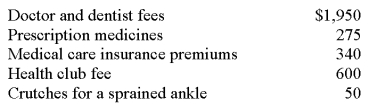

Maria is single and age 32.In 2014,she had AGI of $35,000.During the year,she incurred and paid the following medical costs:  What is Maria's medical expense deduction (after application of the adjusted gross income limitation) for her 2014 tax return?

What is Maria's medical expense deduction (after application of the adjusted gross income limitation) for her 2014 tax return?

A) $3,500.

B) $3,215.

C) $2,615.

D) $ 0.

Correct Answer:

Verified

Q32: For investment interest expense in 2014,the deduction

Q33: In the past,high-income taxpayers' itemized deductions have

Q34: Which of the following interest expenses incurred

Q39: For 2014,Jorge,a single father,reported the following amounts

Q43: Which of the following may not be

Q49: Which of the following expenses is not

Q53: Abel's car was completely destroyed in an

Q55: Taxes deductible as an itemized deduction include

Q66: Which of the following miscellaneous itemized deductions

Q105: If the donation is greater than $250,what

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents