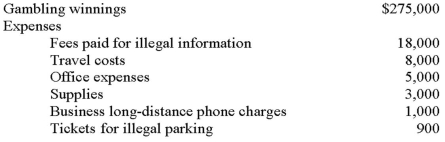

Patricia,a professional gambler,had the following income and expenses in her business:  How much net income must Patricia report from this business?

How much net income must Patricia report from this business?

A) $0.

B) $239,100.

C) $240,000.

D) $258,000.

Correct Answer:

Verified

Q26: Sole proprietors must pay self-employment tax on

Q27: Della purchased a warehouse on February 25,2014,for

Q28: Trade or business expenses are treated as:

A)Deductible

Q30: Paola purchased an office building on January

Q30: Which expenses incurred in a trade or

Q31: In July 2014,Cassie purchases equipment for $55,000

Q33: If an activity is characterized as a

Q34: On May 26,2010,Jamal purchased machinery for $30,000

Q37: In June 2014,Kelly purchased new equipment for

Q40: When business property is lost in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents