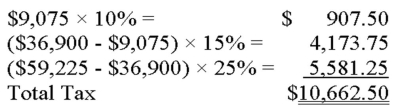

Tameka has taxable income of $59,225 that is taxed as follows:  Her marginal tax rate is:

Her marginal tax rate is:

A) 25%.

B) 18%.

C) 15%.

D) 10%.

Correct Answer:

Verified

Q78: The tax liability for a single individual

Q82: Taxpayers can file a Form 1040EZ if

Q84: On Form 1040EZ,the permitted deduction from income

Q89: Circular 230:

A)Establishes penalties for failure to comply

Q91: Which of the following courts has the

Q93: The least-complex individual income tax return is

Q96: Which of the following is not an

Q97: Which of the following statements is false

Q110: Which of the following refers to an

Q114: Victoria determined her tax liability was $6,451.Her

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents