A company issued 10%,10-year bonds with a par value of $1,000,000 on January 1,at a selling price of $885,295,to yield the buyers a 12% return.The company uses the effective interest amortization method.Interest is paid semiannually each June 30 and December 31.

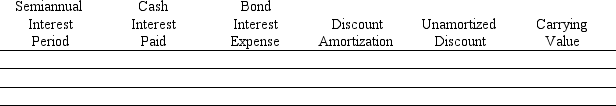

(1)Prepare an amortization table for the first two payment periods using the format shown below:

(2)Prepare the journal entry to record the first semiannual interest payment.

(2)Prepare the journal entry to record the first semiannual interest payment.

Correct Answer:

Verified

Cash payment: $1,000,000 * ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: A company issued 9.2%, 10-year bonds with

Q126: Martin Corporation issued $3,000,000 of 8%, 20-year

Q135: Shin Company has a loan agreement that

Q138: Harrison Company's balance sheet reflects total assets

Q142: A company issues bonds with a par

Q143: On January 1,the Plimpton Corporation leased some

Q146: Hornet Corporation has a loan agreement that

Q161: Explain the amortization of a bond premium.

Q182: On January 1, a company issued 10-year,

Q191: A company issued 10-year, 9% bonds, with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents