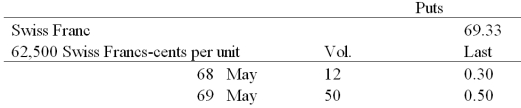

In the CURRENCY TRADING section of The Wall Street Journal,the following appeared under the heading OPTIONS: Philadelphia Exchange

Which combination of the following statements are true? (i) - The time values of the 68 May and 69 May put options are respectively .30 cents and .50 cents.

(ii) - The 68 May put option has a lower time value (price) than the 69 May put option.

(iii) - If everything else is kept constant,the spot price and the put premium are inversely related.

(iv) - The time values of the 68 May and 69 May put options are,respectively,1.63 cents and 0.83 cents.

(v) - If everything else is kept constant,the strike price and the put premium are inversely related.

A) (i) , (ii) , and (iii)

B) (ii) , (iii) , and (iv)

C) (iii) and (iv)

D) ( iv) and (v)

Correct Answer:

Verified

Q22: Consider the graph of a call option

Q22: Exercise of a currency futures option results

Q28: Open interest in currency futures contracts

A)tends to

Q28: Which of the lines is a graph

Q32: A currency futures option amounts to a

Q33: An investor believes that the price of

Q36: The "open interest" shown in currency futures

Q39: The current spot exchange rate is $1.55

Q39: An "option" is

A)a contract giving the seller

Q39: Which of the follow options strategies are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents