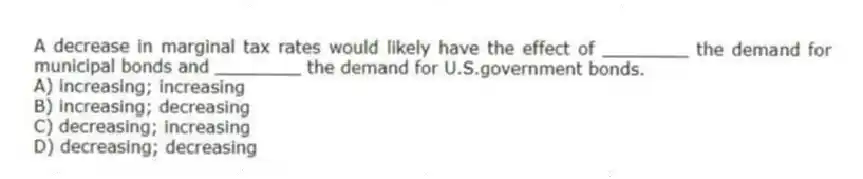

A decrease in marginal tax rates would likely have the effect of ________ the demand for municipal bonds and ________ the demand for U.S.government bonds.

A) increasing; increasing

B) increasing; decreasing

C) decreasing; increasing

D) decreasing; decreasing

Correct Answer:

Verified

Q23: The relationship among interest rates on bonds

Q24: Typically,yield curves are

A) gently upward-sloping.

B) gently downward-sloping.

C)

Q25: Which of the following statements are true?

A)

Q26: When the corporate bond market becomes less

Q27: (I)If a corporate bond becomes less liquid,the

Q29: When the corporate bond market becomes more

Q30: When a municipal bond is given tax-free

Q31: Which of the following statements are true?

A)

Q32: If income tax rates rise,then

A) the prices

Q33: Yield curves can be classified as

A) upward-sloping.

B)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents