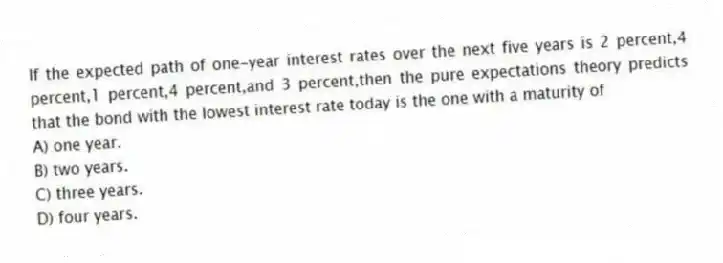

If the expected path of one-year interest rates over the next five years is 2 percent,4 percent,1 percent,4 percent,and 3 percent,then the pure expectations theory predicts that the bond with the lowest interest rate today is the one with a maturity of

A) one year.

B) two years.

C) three years.

D) four years.

Correct Answer:

Verified

Q37: An increase in marginal tax rates would

Q38: Corporate bonds are not as liquid as

Q39: The Bush tax cut passed in 2001

Q40: (I)If a corporate bond becomes less liquid,the

Q43: If the yield curve slope is flat,the

Q44: According to the market segmentation theory of

Q45: According to the liquidity premium theory of

Q46: According to the expectations theory of the

Q47: According to the market segmentation theory of

Q96: According to the liquidity premium theory of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents