A company had poor internal control over its cash transactions.Facts about its cash position at June 30,2008,were as follows:

The cash account showed a balance of $37,804,which included undeposited receipts.A credit of $200 on the bank's records did not appear on the books of the company.The balance per the bank statement was $31,102.Outstanding cheques were: No.62 for $232,No.183 for $300,No.284 for $506,No.8621 for $382,No.8623 for $414,and No.8632 for $290.

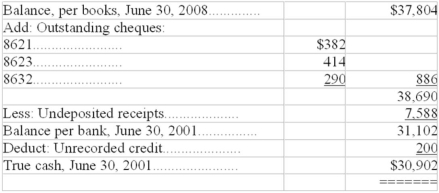

The cashier removed all undeposited receipts in excess of $7,588 and prepared the following reconciliation:  Prepare a supporting schedule showing how much the cashier removed.Also,explain how the cashier attempted to conceal the theft.

Prepare a supporting schedule showing how much the cashier removed.Also,explain how the cashier attempted to conceal the theft.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: A company has $9,000 on deposit in

Q89: At the end of the accounting year,

Q92: Entel Inc. factored $100,000 of its accounts

Q92: A company is preparing its bank reconciliation

Q97: A company had a petty cash

Q98: E Company's bank statement and cash

Q99: Digitex Inc.factored $50,000 of its accounts

Q105: A method of estimating bad debts that

Q109: When the allowance method of recognizing bad

Q111: Total sales for the period amounted to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents