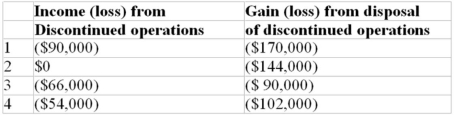

Ace Corporation decided to sell its medical supplies business segment for $500,000,on September 1,Year 1.The disposal date is November 1,Year 1.The book value of the segment's net assets is $650,000.The pre-tax income for the segment for the period January 1 - September 1,Year 1,was a loss of $90,000; the pre-tax income for the segment for September and October was a loss of $20,000.Assuming a tax rate of 40%,choose the correct reporting for discontinued operations in the income statement of Ace Corporation,for the year ended December 31,Year 1.

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

Correct Answer:

Verified

Q65: Under IFRS, to qualify as a discontinued

Q75: The results from operation of a discontinued

Q77: Given the following amounts from an income

Q78: Queen Corporation decided to sell its

Q79: A company which lost part of its

Q83: A company sold a used operational asset

Q84: The following data are available for 2001

Q85: A company had 70,000 shares of common

Q96: A corporation reported 19X1 net income of

Q100: A company had 20,000 shares of common

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents