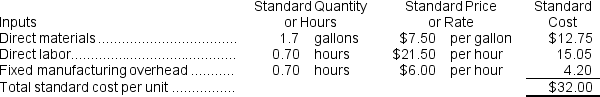

Neuhaus Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

During the year, the company completed the following transactions:

During the year, the company completed the following transactions:

a. Purchased 52,900 gallons of raw material at a price of $7.60 per gallon.

b. Used 46,820 gallons of the raw material to produce 27,600 units of work in process.

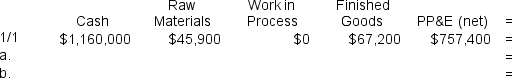

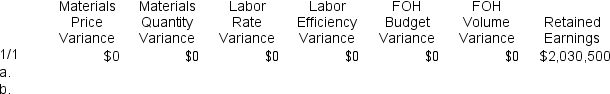

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When recording the raw materials purchases in transaction (a) above,the Raw Materials inventory account will increase (decrease) by:

A) $396,750

B) ($402,040)

C) $402,040

D) ($396,750)

Correct Answer:

Verified

Q38: Phann Corporation manufactures one product. It does

Q39: Phann Corporation manufactures one product. It does

Q40: Phann Corporation manufactures one product. It does

Q41: Bohon Corporation manufactures one product. It does

Q42: Neuhaus Corporation manufactures one product. It does

Q44: Decena Corporation manufactures one product. It does

Q45: Bohon Corporation manufactures one product. It does

Q46: Bohon Corporation manufactures one product. It does

Q47: Ester Corporation manufactures one product. It does

Q48: Neuhaus Corporation manufactures one product. It does

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents