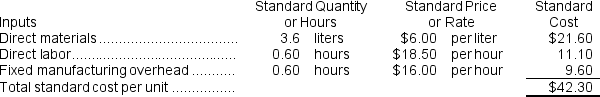

Santiago Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $192,000 and budgeted activity of 12,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $192,000 and budgeted activity of 12,000 hours.

During the year,the company completed the following transactions:

a.Purchased 53,000 liters of raw material at a price of $6.80 per liter.

b.Used 47,620 liters of the raw material to produce 13,200 units of work in process.

c.Assigned direct labor costs to work in process.The direct labor workers (who were paid in cash)worked 8,220 hours at an average cost of $19.20 per hour.

d.Applied fixed overhead to the 13,200 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed.Actual fixed overhead costs for the year were $180,700.Of this total,$116,700 related to items such as insurance,utilities,and indirect labor salaries that were all paid in cash and $64,000 related to depreciation of manufacturing equipment.

e.Transferred 13,200 units from work in process to finished goods.

f.Sold for cash 12,800 units to customers at a price of $56.50 per unit.

g.Completed and transferred the standard cost associated with the 12,800 units sold from finished goods to cost of goods sold.

h.Paid $39,000 of selling and administrative expenses.

i.Closed all standard cost variances to cost of goods sold.

Required:

1.Compute all direct materials,direct labor,and fixed overhead variances for the year.

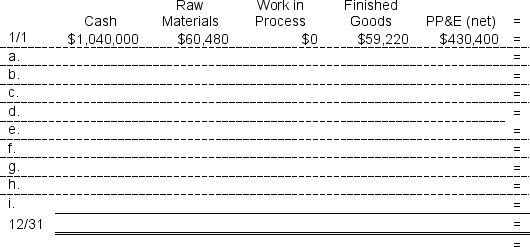

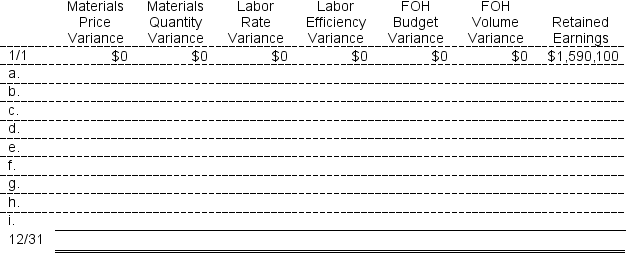

2.Record the above transactions in the worksheet that appears below.Because of the width of the worksheet,it is in two parts.In your text,these two parts would be joined side-by-side to make one very wide worksheet.The beginning balances have been provided for each of the accounts,including the Property,Plant,and Equipment (net)account which is abbreviated as PP&E (net).

3.Determine the ending balance (e.g.,12/31 balance)in each account.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q128: Pioli Corporation manufactures one product.It does not

Q129: Segers Corporation manufactures one product.It does not

Q130: Obenshain Corporation manufactures one product.The company uses

Q131: Lanciotti Corporation manufactures one product.It does not

Q132: Woodhouse Corporation manufactures one product.It does not

Q133: Cleland Corporation manufactures one product.It does not

Q134: Gathman Corporation manufactures one product.It does not

Q135: Zaino Corporation manufactures one product.It does not

Q137: Floria Corporation manufactures one product.It does not

Q138: Ferrini Corporation manufactures one product.It does not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents