The Collins Corporation uses a job-order costing system and applies manufacturing overhead cost to jobs on the basis of the cost of materials used in production.At the beginning of the most recent year,the following estimates were made as a basis for computing the predetermined overhead rate for the year:

manufacturing overhead cost,$200,000; direct materials cost,$160,000.The following transactions took place during the year (all purchases and services were acquired on account):

a.Raw materials were purchased,$86,000.

b.Raw materials were requisitioned for use in production (all direct materials),$98,000.

c.Utility costs were incurred in the factory,$15,000.

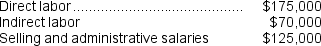

d.Salaries and wages were incurred as follows:

e.Maintenance costs incurred in the factory,$15,000.

e.Maintenance costs incurred in the factory,$15,000.

f.Advertising costs incurred,$89,000.

g.Depreciation recorded for the year,$80,000 (80% relates to factory assets and the remainder relates to selling,general,and administrative assets).

h.Rental cost incurred on buildings,$70,000,(75% of the space is occupied by the factory,and 25% is occupied by sales and administration).

i.Miscellaneous selling,general,and administrative costs incurred,$11,000.

j.Manufacturing overhead cost was applied to jobs as per company policy.

k.Cost of goods manufactured for the year,$500,000.

l.Sales for the year totaled $1,000,000.These goods cost $600,000 to produce.

Required:

Prepare journal entries for each of the above transactions.Assume that all transactions with external suppliers,employees,and customers were conducted in cash.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q217: Stockman Inc. has provided the following data

Q218: Chavez Corporation reported the following data for

Q219: Castagnola Inc. has provided the following data

Q220: Dacosta Corporation had only one job in

Q221: Gonzalez,Inc.manufactures stereo speakers in two factories; one

Q223: Held Inc. has provided the following data

Q224: Sefcovic Enterprises LLC recorded the following transactions

Q226: Held Inc. has provided the following data

Q227: Easterling Corporation uses a job-order costing system.The

Q275: Fossil Manufacturing uses a predetermined overhead rate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents