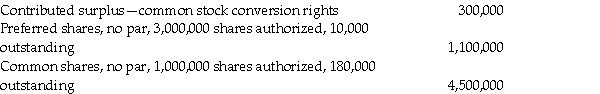

LMN Company reported the following amounts on its balance sheet at July 31,2018:

Liabilities

Convertible bonds payable,$10,000,000 face value 9%,due July 31,2019 9,909,091

Equity

Additional information

1.The bonds pay interest each July 31.Each $1,000 bond is convertible into 10 common shares.The bonds were originally issued to yield 10%.On July 31,2019,all the bonds were converted after the final interest payment was made.LMN uses the book value method to record bond conversions as recommended under IFRS.

2.No other share or bond transactions occurred during the year.

Required:

a.Prepare the journal entry to record the bond interest payment on July 31,2019.

b.Calculate the total number of common shares outstanding after the bonds' conversion on July 31,2019.

c.Prepare the journal entry to record the bond conversion.

Correct Answer:

Verified

Q26: How would exercise of warrants that were

Q34: How would the exercise of an option,

Q50: Which method is used under ASPE to

Q51: Which method must be used under IFRS

Q54: A company had a debt-to-equity ratio of

Q55: Which method is used under ASPE to

Q70: Which statement best describes the "incremental method"?

A)Under

Q72: LMN Company reported the following amounts on

Q80: A company issued 100,000 preferred shares and

Q99: What are the similarities and differences between

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents