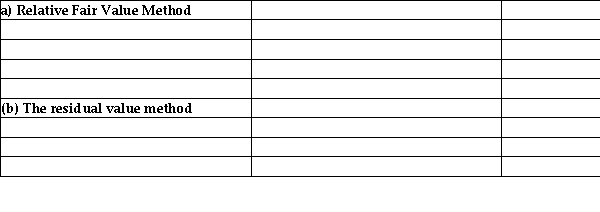

Ellwoods Bar and Grill Ltd.sells 1,000 packages of equity security consisting of one common share and one preferred share.Each package was sold for $100;total proceeds were $100,000.At time of sale,the market price of the common shares was $91.00 and the estimated fair value of the preferred shares was $10.00.Contrast the two alternative methods of accounting for this bundled purchase (a)The company uses the relative fair value method and (b)the company uses the residual value method.Use the following table:

Correct Answer:

Verified

Q1: What is the meaning of "shares authorized,"

Q10: In which account would "transactions with owners"

Q24: What kind of transaction is "appropriated reserves"?

A)An

Q25: If 10,000 shares with par value of

Q32: In which account would "transactions with non-owners"

Q34: When shares are repurchased at an amount

Q53: What are three potential outcomes for defaults

Q54: List and explain four reasons why a

Q55: Briefly describe the primary reason why companies

Q72: What is the economic significance of "par

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents