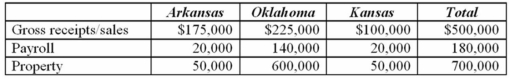

Tri-State's, Inc. operates in Arkansas, Oklahoma, and Kansas. Assume that each state has adopted the UDITPA formula. During the corporation's tax year ended December 31, the apportionment data indicated:  Which of the following statements is true?

Which of the following statements is true?

A) The sales factor for Arkansas is approximately 35%.

B) Arkansas payroll percentage is approximately 11.1%.

C) The property factor for Arkansas is approximately 7.14%.

D) All of the above factors for Arkansas are correct.

Correct Answer:

Verified

Q43: Which of the following activities create state

Q44: Which of the following statements concerning the

Q47: Which of the following could result in

Q48: Which of the following statements about the

Q48: Tri-State's, Inc. operates in Arkansas, Oklahoma, and

Q51: Harris Corporation's before-tax income was $400,000.It does

Q51: Lexington Corporation conducts business in four states.

Q52: Albany, Inc. does business in states C

Q55: Economic nexus:

A) May exist even though a

Q60: Section 482 of the Internal Revenue Code

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents