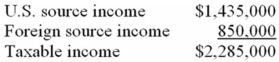

Koscil Inc. had the following taxable income.  Koscil paid $315,000 foreign income tax. Compute its U.S. income tax liability.

Koscil paid $315,000 foreign income tax. Compute its U.S. income tax liability.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Logan,an Indiana corporation,conducts its international business through

Q92: The Quad affiliated group consists of Quad,

Q93: Lincoln Corporation,which has a 34% marginal tax

Q95: Which of the following statements about subpart

Q96: In which of the following cases are

Q100: Orchid Inc.,a U.S.multinational with a 34% marginal

Q102: Pogo,Inc.,which has a 34 percent marginal tax

Q102: Sunny, a California corporation, earned the following

Q107: This year, Plateau, Inc.'s before-tax income was

Q111: Transfer pricing issues arise:

A)When tangible goods are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents