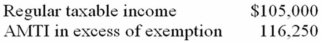

Sunny Vale Co. reported the following for the current tax year:  Compute Sunny Vale's total income tax liability.

Compute Sunny Vale's total income tax liability.

A) $23,250

B) $950

C) $24,200

D) $47,450

Correct Answer:

Verified

Q43: Sonic Corporation has a 35% marginal tax

Q59: The burden of corporate taxation is often

Q60: Wave Corporation owns 90% of the stock

Q64: Slipper Corporation has book income of $500,000.

Q65: Calliwell Corporation is a Colorado corporation engaged

Q69: Lexington Associates,Inc.is a personal service corporation.This year,Lexington

Q73: Which of the following statements regarding Schedule

Q74: Which of the following statements regarding the

Q78: A corporation that owns more than $10

Q99: Which of the following could cause a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents