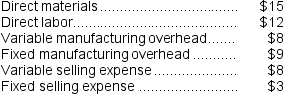

The Melville Corporation produces a single product called a Pong. Melville has the capacity to produce 60,000 Pongs each year. If Melville produces at capacity, the per unit costs to produce and sell one Pong are as follows:

The regular selling price for one Pong is $80. A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year. If this special order is accepted, the variable selling expense will be reduced by 75%. However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order. This machine will cost $9,000 and it will have no use after the special order is filled. The total fixed manufacturing overhead and selling expenses would be unaffected by this special order. Assume that direct labor is a variable cost.

The regular selling price for one Pong is $80. A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year. If this special order is accepted, the variable selling expense will be reduced by 75%. However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order. This machine will cost $9,000 and it will have no use after the special order is filled. The total fixed manufacturing overhead and selling expenses would be unaffected by this special order. Assume that direct labor is a variable cost.

-Assume Melville can sell 58,000 units of Pong to regular customers next year.If Mowen Corporation offers to buy the 6,000 special order units at $65 per unit,the annual financial advantage (disadvantage) for Melville as a result of accepting this special order should be:

A) $36,000

B) $11,000

C) $192,000

D) $47,000

Correct Answer:

Verified

Q153: Younes Inc. manufactures industrial components. One of

Q154: The Carter Corporation makes products A and

Q155: Cranston Corporation makes four products in a

Q156: Younes Inc. manufactures industrial components. One of

Q157: The Wester Corporation produces three products with

Q159: The Wester Corporation produces three products with

Q160: Bruce Corporation makes four products in a

Q161: Recher Corporation uses part Q89 in one

Q162: Kirsten Corporation makes 100,000 units per year

Q163: Dock Corporation makes two products from a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents