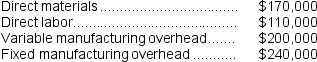

Krepps Corporation produces a single product. Last year, Krepps manufactured 20,000 units and sold 15,000 units. Production costs for the year were as follows:

Sales totaled $825,000 for the year, variable selling and administrative expenses totaled $108,000, and fixed selling and administrative expenses totaled $165,000. There was no beginning inventory. Assume that direct labor is a variable cost.

Sales totaled $825,000 for the year, variable selling and administrative expenses totaled $108,000, and fixed selling and administrative expenses totaled $165,000. There was no beginning inventory. Assume that direct labor is a variable cost.

-Under variable costing,the company's net operating income for the year would be:

A) $101,250 lower than under absorption costing.

B) $60,000 lower than under absorption costing.

C) $101,250 higher than under absorption costing.

D) $60,000 higher than under absorption costing.

Correct Answer:

Verified

Q207: Data for January for Bondi Corporation and

Q208: Helmers Corporation manufactures a single product. Variable

Q209: Norenberg Corporation manufactures a single product. The

Q210: Danahy Corporation manufactures a single product. The

Q211: Nantor Corporation has two divisions, Southern and

Q213: Clemeson Corporation, which has only one product,

Q214: Azuki Corporation operates in two sales territories,

Q215: Azuki Corporation operates in two sales territories,

Q216: Nantor Corporation has two divisions, Southern and

Q217: Helmers Corporation manufactures a single product. Variable

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents