Dagostino Corporation uses a job-order costing system. The following data relate to the just completed month's operations.

(1) Direct materials requisitioned for use in production, $154,000

(2) Indirect materials requisitioned for use in production, $45,000

(3) Direct labor wages incurred, $94,000

(4) Indirect labor wages incurred, $119,000

(5) Depreciation recorded on factory equipment, $44,000

(6) Additional manufacturing overhead costs incurred, $83,000

(7) Manufacturing overhead costs applied to jobs, $236,000

(8) Cost of jobs completed and transferred from Work in Process to Finished Goods, $458,000

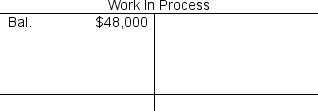

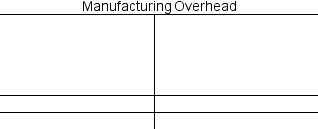

Where appropriate, post the above transactions to the Work in Process and Manufacturing Overhead T-accounts below.

-The manufacturing overhead was:

A) $10,000 Underapplied

B) $10,000 Overapplied

C) $55,000 Underapplied

D) $55,000 Overapplied

Correct Answer:

Verified

Q189: Boursaw Corporation has provided the following data

Q190: Hunkins Corporation has provided the following data

Q191: Dagostino Corporation uses a job-order costing system.

Q192: Dagostino Corporation uses a job-order costing system.

Q193: Boursaw Corporation has provided the following data

Q195: Hunkins Corporation has provided the following data

Q196: Hunkins Corporation has provided the following data

Q197: Boursaw Corporation has provided the following data

Q198: Leak Enterprises LLC recorded the following transactions

Q199: Leak Enterprises LLC recorded the following transactions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents