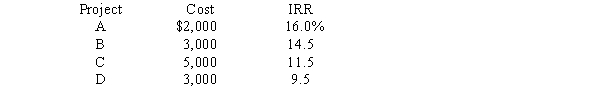

Anderson Company has four investment opportunities with the following costs (all costs are paid at t = 0) and estimated internal rates of return (IRR) :  The company has a target capital structure which consists of 40 percent common equity,40 percent debt,and 20 percent preferred stock.The company has $1,000 in retained earnings.The company expects its year-end dividend to be $3.00 per share .The dividend is expected to grow at a constant rate of 5 percent a year.The company's stock price is currently $42.75.If the company issues new common stock,the company will pay its investment bankers a 10 percent flotation cost.The company can issue corporate bonds with a yield to maturity of 10 percent.The company is in the 35 percent tax bracket.How large can the cost of preferred stock be (including flotation costs) and it still be profitable for the company to invest in all four projects?

The company has a target capital structure which consists of 40 percent common equity,40 percent debt,and 20 percent preferred stock.The company has $1,000 in retained earnings.The company expects its year-end dividend to be $3.00 per share .The dividend is expected to grow at a constant rate of 5 percent a year.The company's stock price is currently $42.75.If the company issues new common stock,the company will pay its investment bankers a 10 percent flotation cost.The company can issue corporate bonds with a yield to maturity of 10 percent.The company is in the 35 percent tax bracket.How large can the cost of preferred stock be (including flotation costs) and it still be profitable for the company to invest in all four projects?

A) 7.75%

B) 8.90%

C) 10.46%

D) 11.54%

E) 12.68%

Correct Answer:

Verified

Q26: Gulf Electric Company (GEC)

Gulf Electric Company (GEC)

Q41: Rollins Corporation

Rollins Corporation is constructing its MCC

Q46: Rollins Corporation

Rollins Corporation is constructing its MCC

Q51: Jackson Company

The Jackson Company has just paid

Q53: Rollins Corporation

Rollins Corporation is constructing its MCC

Q56: Rollins Corporation

Rollins Corporation is constructing its MCC

Q60: Rollins Corporation

Rollins Corporation is constructing its MCC

Q66: Tapley Inc.'s current (target)capital structure has a

Q68: Your company's stock sells for $50 per

Q73: SW Ink's preferred stock,which pays a $5

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents