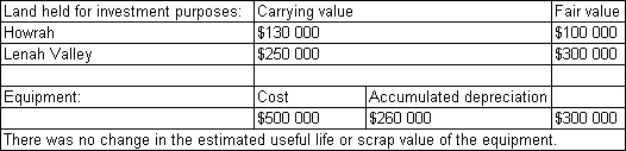

Stairway Ltd is undertaking its regular review of the fair value of its assets.It has discovered the following material changes

What are the journal entries required to record the revaluations in accordance with relevant accounting standards?

A)

B)

C)

D)

Correct Answer:

Verified

Q43: AASB 116 prescribes that,if assets within the

Q44: Which of the following statement is true

Q45: When an entity adopts the valuation model

Q46: Under AASB 116 when an asset is

Q47: Which of the following statements is true

Q49: Chopin Ltd has a debt contract and

Q50: Where management's bonuses are tied to profit-based

Q51: Staples Ltd has invested in two

Q52: When an item of property,plant and equipment

Q53: Palm Beach Ltd has elected to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents