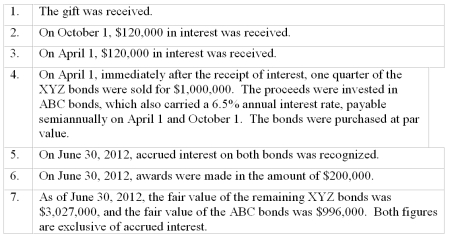

On July 1,2011,the City of Corfu received a gift of debt securities of XYZ Company with a nominal (par)value of $4,000,000.Income is to be used to make awards for civic achievements.As of the date of the gift,the securities had a market value of $4,088,000,including accrued interest of $60,000.The bonds carried an annual interest rate of 6%,payable semiannually on April 1 and October 1.During the fiscal year ended June 30,2012,the following transactions took place:

Required:

Required:

A.Record the above transactions on the books of the City of Corfu Private-Purpose Trust Fund.

B.Prepare a Statement of Changes in Fiduciary Net Assets for the City of Corfu Private-Purpose Trust Fund for the year ended June 30,2012.

Correct Answer:

Verified

Q122: Contrast a defined benefit and defined contribution

Q125: Which of the following statements is correct

Q127: Contrast the accounting for internal and external

Q132: What is a cost sharing state pension

Q144: GASB No.53 establishes reporting requirements for governments

Q153: Jefferson County maintains a tax agency fund

Q154: Washington County assumed the responsibility of collecting

Q158: List four attributes of an Agency Fund.

Q159: When a contributor and a government agree

Q162: The City of Richmond maintains a Public

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents