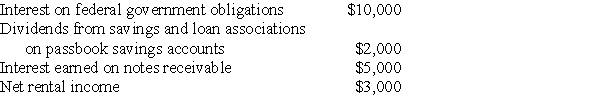

Investors Corporation has ten unrelated individual shareholders who each own 10% of the outstanding stock.For their tax year ended December 31 of this year,Investors' gross income includes:

No dividends are paid during the tax year or during the 2-1/2 month throwback period.Deductible administrative expenses total $4,000 for the year.Rental income has been reduced by $1,000 of depreciation and $2,000 of interest expense.What is Investors' undistributed personal holding company income?

No dividends are paid during the tax year or during the 2-1/2 month throwback period.Deductible administrative expenses total $4,000 for the year.Rental income has been reduced by $1,000 of depreciation and $2,000 of interest expense.What is Investors' undistributed personal holding company income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: The personal holding company tax

A)may be imposed

Q13: Which of the following actions cannot be

Q23: Identify which of the following statements is

Q26: Church Corporation is a closely held C

Q28: A corporation can be subject to both

Q29: The accumulated earnings tax does not apply

Q34: Identify which of the following statements is

Q40: What is a personal holding company?

Q60: Rich Company sold equipment this year for

Q70: Khuns Corporation,a personal holding company,reports the following:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents