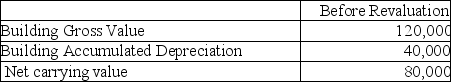

Wilson Inc wishes to use the revaluation model for this property:

The fair value for the property is $20,000.What amount would be booked to the "accumulated depreciation" account if Wilson chooses to use the proportional method to record the revaluation?

A) $0

B) $30,000 debit.

C) $30,000 credit.

D) $60,000 debit.

Correct Answer:

Verified

Q4: Which statement describes the "revaluation model"?

A)A model

Q8: Wallace Inc wishes to use the revaluation

Q9: Grover Inc wishes to use the revaluation

Q10: Smith Inc wishes to use the revaluation

Q11: How is revaluation of non-current assets accounted

Q13: Wallace Inc wishes to use the revaluation

Q14: Smith Inc wishes to use the revaluation

Q15: Wallace Inc wishes to use the revaluation

Q16: Grover Inc wishes to use the revaluation

Q17: Grover Inc wishes to use the revaluation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents