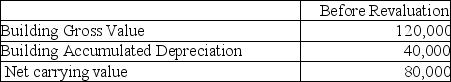

Wilson Inc wishes to use the revaluation model for this property:

The fair value for the property is $140,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much depreciation expense would be recorded in the year subsequent to the revaluation?

A) $16,000 debit.

B) $16,000 credit.

C) $28,000 credit.

D) $28,000 debit.

Correct Answer:

Verified

Q24: Company Twelve purchased land for $900,000 some

Q33: Smith Inc wishes to use the revaluation

Q34: Wallace Inc wishes to use the revaluation

Q35: Wilson Inc wishes to use the revaluation

Q37: Smith Inc wishes to use the revaluation

Q39: Wallace Inc wishes to use the revaluation

Q40: Wilson Inc wishes to use the revaluation

Q43: What is the recoverable amount for this

Q48: What are "costs of disposal"?

A)The incremental costs

Q49: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents