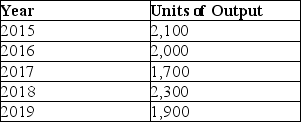

Billu Limited purchased equipment on January 1,2015 for $275,000.It was estimated that the equipment would have a residual value of $25,000 at the end of its useful life.The asset's useful life was estimated at 5 years or 10,000 units of output.The company has a December 31 year end.Additional information:

Assuming the company uses the units-of-production depreciation method,calculate the depreciation expense for 2018.

A) $25.00

B) $57,500

C) $63,250

D) $202,500

Correct Answer:

Verified

Q74: Ontario Ltd.owns a machine that it purchased

Q75: Base-Forward owns a machine that it purchased

Q76: Fantasmic Moulds purchased equipment on January 1,2015

Q77: Oregona Ltd.owns a machine that it purchased

Q78: Easter Corp.owns a machine that it purchased

Q80: Scandsia Ltd.owns a machine that it purchased

Q82: A machine was acquired on January 1,2018

Q83: AccountingPro purchased equipment on January 1,2015 for

Q86: Discuss how a company can manipulate earnings

Q94: Explain how the depreciation method should be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents