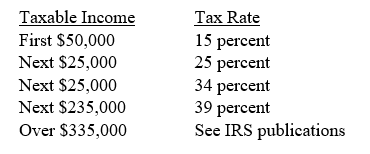

For the current year, Folk Enterprises, Inc. reported net income before income taxes of $300,000. Using the following corporate income tax rates, compute the corporation's federal income taxes payable. (Assume that the firm's taxable income is the same as its income for financial accounting purposes.)

Correct Answer:

Verified

Q85: The total of the owners' claims to

Q86: The Matt Tress Sofa Company has 11,000

Q87: The income statement of a corporation and

Q88: On the worksheet for the current year

Q89: A corporation paid estimated income taxes of

Q91: A corporation paid estimated income taxes of

Q92: The Matt Tress Sofa Company has 11,000

Q93: For the current year, Carlton Corporation reported

Q94: On the worksheet for the current year

Q95: A corporation paid estimated income taxes of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents