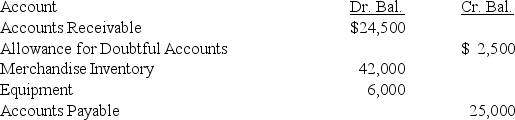

The Ventura Corporation, a new corporation, took over the assets and liabilities of the Jeremy Ruggers Company on January 2, 2019. The assets and liabilities assumed, after appropriate revaluation by Ruggers Company, are shown below.

The Ventura Corporation is authorized to issue 100,000 shares of $10 par-value common stock and 50,000 shares of 12 percent, $50 par-value preferred stock.

Jan. 2 The corporation issued 3,000 shares of common stock and 300 shares of preferred stock at par to Ruggers for his equity in the sole proprietorship business and the corporation took over Ruggers' assets and liabilities.

2 Issued 2,500 shares of common stock to Shaundra Ferris at par value for cash.

2 Issued 800 shares of common stock and 200 shares preferred stock to Celina Delgado at par value for cash.

Required:

1. Record the transactions on page 1 of a general journal. Omit descriptions.

2. Prepare the opening balance sheet for the corporation on January 2, 2019

3. If Ventura Corporation paid $900 for legal fees, charter fee, and cost of engraving stock certificates, how would this transaction be recorded?

Correct Answer:

Verified

Q78: Santorini Corporation has outstanding 300,000 shares of

Q79: For the year just ended, a company

Q80: The entry to record the issuance of

Q81: The Odegard Corporation has outstanding 80,000 shares

Q82: On July 1, 2019, Abbott Corporation received

Q84: The Maynard Corporation has outstanding 10,000 shares

Q85: The Southeast Corporation has outstanding 40,000 shares

Q86: The Northwest Corporation has outstanding 20,000 shares

Q87: McDougall Corporation issued 40,000 shares of its

Q88: Cary Company, a newly organized corporation, received

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents