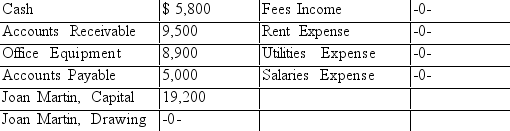

The consulting firm of Martin and Associates uses the accounts listed below. On a separate sheet of paper, set up T accounts for each of the accounts listed and record the balances as of December 1, 2019 on the normal balance side of the accounts.

The firm has the following transactions during the month of December 2019. Record the effects of these transactions in the T accounts.

a. Paid $2,100 for one month's rent

b. Collected $4,500 in cash from credit customers

c. Performed services for $8,300 in cash

d. Paid $5,300 for salaries

e. Issued a check for $2,750 to a creditor

f. Performed services for $11,650 on credit

g. Purchased office equipment for $3,200 on credit

h. The owner withdrew $2,800 in cash for personal expenses

i. Issued a check for $925 to pay the monthly utility bill

Determine the account balances after the transactions have been recorded Prepare a trial balance as of December 31, 2019.

Correct Answer:

Verified

MARTIN...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q94: The error that occurs when the number

Q95: The account Moriah Paige, Capital, would appear

Q96: In a Chart of Accounts, each category

Q97: The following information should be used for

Q98: The following information should be used for

Q100: Another name for the profit and loss

Q101: Conway Copy Shop is owned and operated

Q102: Conway Copy Shop is owned and operated

Q103: The T account balances for the accounts

Q104: The balances for the accounts listed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents