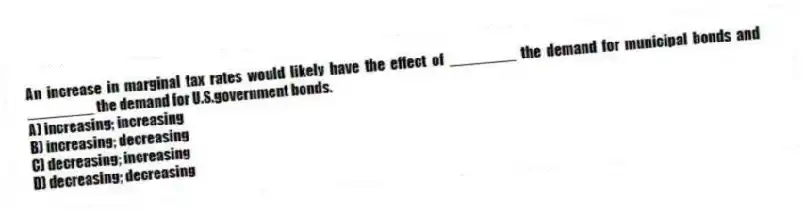

An increase in marginal tax rates would likely have the effect of ________ the demand for municipal bonds and ________ the demand for U.S.government bonds.

A) increasing; increasing

B) increasing; decreasing

C) decreasing; increasing

D) decreasing; decreasing

Correct Answer:

Verified

Q32: If income tax rates rise,then

A) the prices

Q33: Yield curves can be classified as

A) upward-sloping.

B)

Q34: If income tax rates were lowered,then

A) the

Q35: If municipal bonds were to lose their

Q36: (I)The risk premium widens as the default

Q38: Corporate bonds are not as liquid as

Q39: The Bush tax cut passed in 2001

Q40: (I)If a corporate bond becomes less liquid,the

Q42: If the expected path of one-year interest

Q96: According to the liquidity premium theory of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents