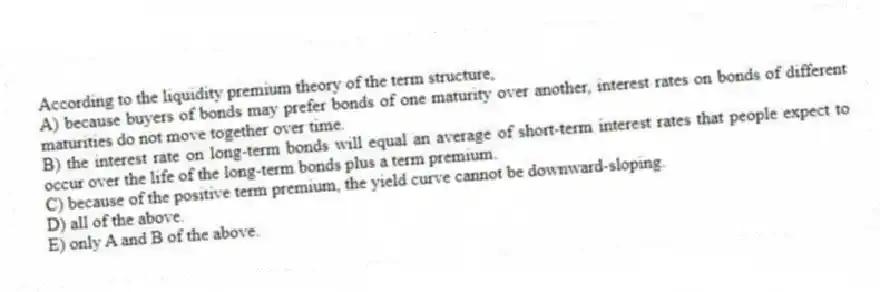

According to the liquidity premium theory of the term structure,

A) because buyers of bonds may prefer bonds of one maturity over another, interest rates on bonds of different maturities do not move together over time.

B) the interest rate on long-term bonds will equal an average of short-term interest rates that people expect to occur over the life of the long-term bonds plus a term premium.

C) because of the positive term premium, the yield curve cannot be downward-sloping.

D) all of the above.

E) only A and B of the above.

Correct Answer:

Verified

Q50: In actual practice,short-term interest rates are just

Q51: According to the expectations theory of the

Q52: According to the expectations theory of the

Q53: According to the expectations theory of the

Q54: The liquidity premium theory of the term

Q56: Which theory of the term structure proposes

Q57: If the yield curve has a mild

Q58: According to the liquidity premium theory of

Q59: The liquidity premium theory of the term

Q60: If the expected path of one-year interest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents