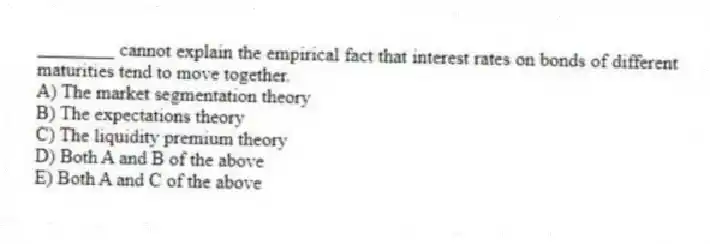

________ cannot explain the empirical fact that interest rates on bonds of different maturities tend to move together.

A) The market segmentation theory

B) The expectations theory

C) The liquidity premium theory

D) Both A and B of the above

E) Both A and C of the above

Correct Answer:

Verified

Q63: Based on the expectations hypothesis,the steep upward

Q64: The risk structure of interest rates describes

Q65: Of the four theories that explain how

Q66: A steep upward-sloping yield curve indicates that

Q67: Following the subprime collapse,the spread (difference)between the

Q69: The term structure of interest rates describes

Q70: Of the four theories that explain how

Q71: _ bonds are exempt from federal income

Q72: The risk structure of interest rates is

Q73: Closely related to the _ is the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents