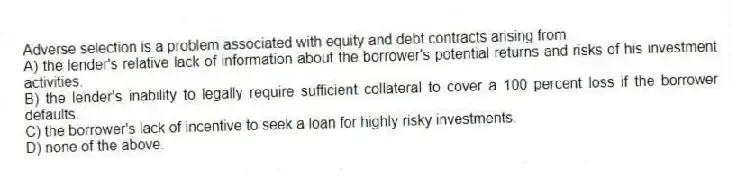

Adverse selection is a problem associated with equity and debt contracts arising from

A) the lender's relative lack of information about the borrower's potential returns and risks of his investment activities.

B) the lender's inability to legally require sufficient collateral to cover a 100 percent loss if the borrower defaults.

C) the borrower's lack of incentive to seek a loan for highly risky investments.

D) none of the above.

Correct Answer:

Verified

Q20: Long-term debt and equity instruments are traded

Q22: Bonds that are sold in a foreign

Q23: Bonds that are sold in a foreign

Q24: An investor who puts all her funds

Q24: The presence of _ in financial markets

Q26: The main sources of financing for businesses,in

Q27: The purpose of diversification is to

A) reduce

Q28: In financial markets,lenders typically have inferior information

Q29: Through risk-sharing activities,a financial intermediary _ its

Q30: The concept of adverse selection helps to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents