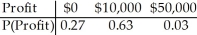

A company bids on two contracts.It anticipates a profit of $50,000 if it gets the larger contract and a profit of $10,000 if it gets the smaller contract.It estimates that there's a 10% chance of winning the larger contract and a 70% chance of winning the smaller contract.Create a probability model for the company's profit.Assume that the contracts will be awarded independently.

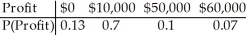

A)

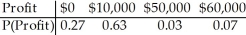

B)

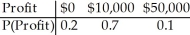

C)

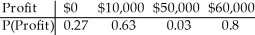

D)

E)

Correct Answer:

Verified

Q1: Sue Anne owns a medium-sized business.The probability

Q2: Hugh buys $8,000 worth of stock in

Q4: An insurance policy costs $400,and will pay

Q5: The probability model below describes the number

Q6: You roll a fair die.If you get

Q7: You pick a card from a deck.If

Q8: The number of golf balls ordered by

Q9: You pick a card from a deck.If

Q10: A couple plans to have children until

Q11: A carnival game offers a $80 cash

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents