Use the information for the question(s) below.

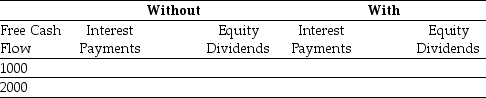

Consider two firms: firm Without has no debt, and firm With has debt of $10,000 on which it pays interest of 5% per year. Both companies have identical projects that generate free cash flows of $1000 or $2000 each year. Suppose that there are no taxes, and after paying any interest on debt, both companies use all remaining cash free cash flows to pay dividends each year.

-Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows:

Correct Answer:

Verified

Q42: Suppose you own 10% of the equity

Q45: Which of the following statements is false?

A)

Q48: What is a market value balance sheet

Q49: Which of the following statements is false?

A)

Q50: Consider the following equation: βU =

Q55: Consider the following equation: E + D

Q56: Suppose you own 10% of the equity

Q56: The cost of capital of levered equity

Q57: Which of the following equations would NOT

Q59: When firm borrows at the _ cost

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents