Multiple Choice

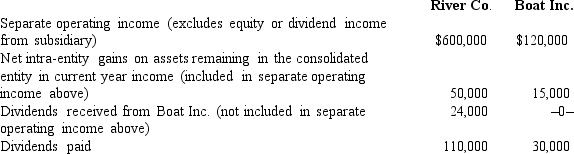

-What was the net income attributable to the noncontrolling interest, assuming that the separate return method was used to assign the income tax expense?

A) $16,800

B) $14,450

C) $14,700

D) $17,450

E) $13,800

Correct Answer:

Verified

Related Questions

Q15: Jastoon Co.acquired all of Wedner Co.for $588,000

Q16: Q17: What amount of dividends should West Corp.recognize Q18: When Buckette prepares consolidated financial statements, it Q19: Q21: Compute Lawrence's accrual-based net income for 2018. Q22: Hardford Corp. held 80% of Inglestone Inc., Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

A)