A U.S.company's foreign subsidiary had the following amounts in stickles (§) , the functional currency, in 2018:  The average exchange rate during 2018 was §1 = $.96.The beginning inventory was acquired when the exchange rate was §1 = $1.20.The ending inventory was acquired when the exchange rate was §1 = $.90.The exchange rate at December 31, 2018 was §1 = $.84.At what amount should the foreign subsidiary's cost of goods sold have been reflected in the 2018 U.S.dollar income statement?

The average exchange rate during 2018 was §1 = $.96.The beginning inventory was acquired when the exchange rate was §1 = $1.20.The ending inventory was acquired when the exchange rate was §1 = $.90.The exchange rate at December 31, 2018 was §1 = $.84.At what amount should the foreign subsidiary's cost of goods sold have been reflected in the 2018 U.S.dollar income statement?

A) $11,253,600.

B) $11,577,600.

C) $11,520,000.

D) $11,613,600.

E) $11,523,600.

Correct Answer:

Verified

Q21: Which method is used for remeasuring a

Q25: Under the current rate method, common stock

Q29: Under the current rate method, retained earnings

Q30: Under the temporal method, common stock would

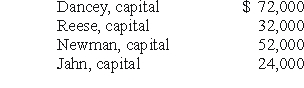

Q33: A U.S.company's foreign subsidiary had the following

Q33: Under the temporal method, retained earnings would

Q36: Under the temporal method, inventory at net

Q37: Under the temporal method, depreciation expense would

Q39: A net liability balance sheet exposure exists

Q49: When preparing a consolidation worksheet for a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents