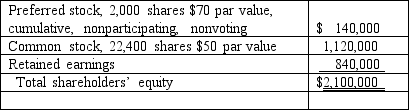

On January 1, 2018, Bast Co.had a net book value of $2,100,000 as follows:

Fisher Co.acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000.Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.

Fisher Co.acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000.Fisher believed that one of Bast's buildings, with a twelve-year life, was undervalued on the company's financial records by $70,000.

Required:

What is the amount of goodwill to be recognized from this purchase?

Correct Answer:

Verified

Q84: On January 1, 2018, Parent Corporation acquired

Q90: Danbers Co.owned seventy-five percent of the common

Q93: Which of the following variable interests entitles

Q95: Which of the following statements regarding consolidation

Q99: Assuming Involved's accounts are correctly valued within

Q101: How are intra-entity inventory transfers treated on

Q103: Parent Corporation recently acquired some of its

Q106: Parent Corporation acquired some of its subsidiary's

Q109: Parent Corporation acquired some of its subsidiary's

Q119: How does the existence of a noncontrolling

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents