Use the following information to answer the question(s) below.

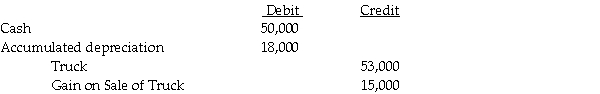

On January 1,2010,Shrimp Corporation purchased a delivery truck with an expected useful life of five years,and a salvage value of $8,000.On January 1,2012,Shrimp sold the truck to Pacet Corporation.Pacet assumed the same salvage value and remaining life of three years used by Shrimp.Straight-line depreciation is used by both companies.On January 1,2012,Shrimp recorded the following journal entry:

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

-In preparing the consolidated financial statements for 2012,the elimination entry for depreciation expense was a

A) debit for $5,000.

B) credit for $5,000.

C) debit for $15,000.

D) credit for $15,000.

Correct Answer:

Verified

Q1: Use the following information to answer the

Q2: Use the following information to answer the

Q4: Pied Imperial Corporation acquired a 90% interest

Q5: On January 1,2012 Saffron Co.recorded a $40,000

Q6: Pogo Corporation acquired a 75% interest in

Q7: The 2011 unrealized gain from the intercompany

Q8: Use the following information to answer the

Q9: Use the following information to answer the

Q10: Use the following information to answer the

Q11: On January 2,2011,Paogo Company sold a truck

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents