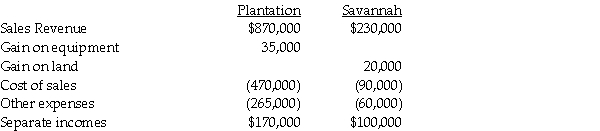

Separate income statements of Plantation Corporation and its 90%-owned subsidiary,Savannah Corporation,for 2011 are as follows,prior to Plantation recording any income related to its subsidiary:

Additional information:

Additional information:

1.Plantation acquired its 90% interest in Savannah Corporation when the book values were equal to the fair values.

2.The gain on equipment relates to equipment with a book value of $95,000 and a 7-year remaining useful life that Plantation sold to Savannah for $130,000 on January 1,2011.The straight-line depreciation method was used and the equipment has no salvage value.

3.On January 1,2011,Savannah sold land to an outside entity for $90,000.The land was acquired from Plantation in 2009 for $70,000.The original cost of the land to Plantation was $45,000.

4.Savannah did not declare or distribute dividends in 2011.

Required:

1.Prepare elimination/adjusting entries on the consolidated worksheet for the year 2011.

2.Prepare the consolidated income statement for the year ended December 31,2011.

Correct Answer:

Verified

Q29: On January 1,2011,Pilgrim Imaging purchased 90% of

Q31: Piglet Incorporated purchased 90% of the outstanding

Q32: Pierce Manufacturing owns all of the outstanding

Q33: Plock Corporation,the 75% owner of Seraphim Company,reported

Q34: Porter Corporation acquired 70% of the outstanding

Q35: Passo Corporation acquired a 70% interest in

Q35: Several years ago,Peacock International purchased 80% of

Q36: Separate income statements of Pingair Corporation and

Q38: Paula's Pizzas purchased 80% of their supplier,Sarah's

Q39: Park Incorporated purchased a 70% interest in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents