PreBuild Manufacturing acquired 100% of Shoding Industries common stock on January 1,2010,for $670,000 when the book values of Shoding's assets and liabilities were equal to their fair values and Shoding's stockholders' equity consisted of $380,000 of Capital Stock and $290,000 of Retained Earnings.

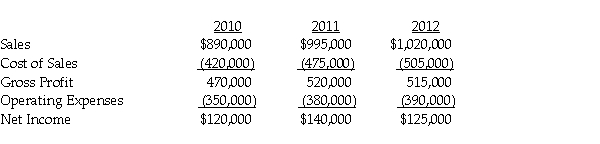

PreBuild's separate income (excluding investment income from Shoding)was $870,000,$830,000 and $960,000 in 2010,2011 and 2012,respectively.PreBuild sold inventory to Shoding during 2010 at a gross profit of $50,000 and 50% remained at Shoding at the end of the year.The remaining 50% was sold in 2011.At the end of 2011,PreBuild has $54,000 of inventory received from Shoding from a sale of $180,000 which cost Shoding $150,000.There are no unrealized profits in the inventory of PreBuild or Shoding at the end of 2012.PreBuild uses the equity method in its separate books.Select financial information for Shoding follows:

Required:

Required:

Prepare a schedule to determine PreBuild Manufacturing's Consolidated net income for 2010,2011,and 2012.

Correct Answer:

Verified

Q26: On January 1,2011,Paar Incorporated paid $38,500 for

Q27: Pastern Industries has an 80% ownership stake

Q28: Pexo Industries purchases the majority of their

Q29: Pittle Corporation acquired a 80% interest in

Q30: Penguin Corporation acquired a 60% interest in

Q32: Plateau Incorporated bought 60% of the common

Q33: On January 1,2011,Palling Corporation purchased 70% of

Q34: Perry Instruments International purchased 75% of the

Q35: Pirate Transport bought 80% of the outstanding

Q36: Plover Corporation acquired 80% of Sink Inc.equity

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents