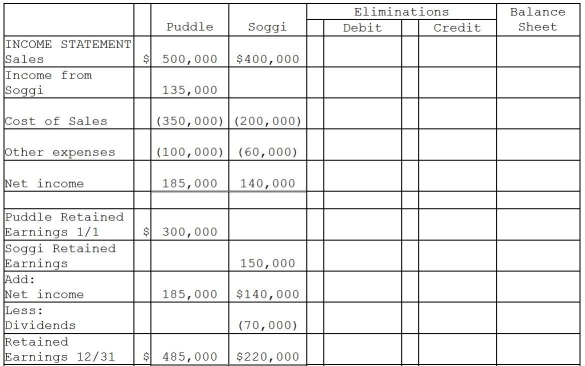

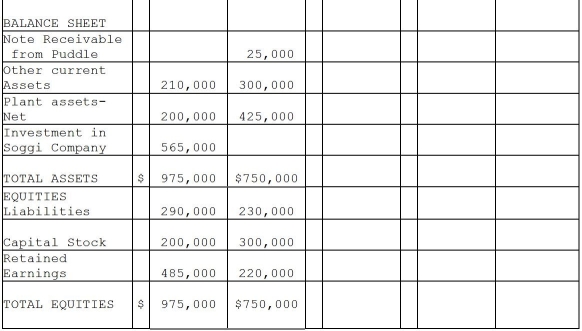

Puddle Corporation acquired all the voting stock of Soggi Company for $500,000 on January 1,2011 when Soggi had Capital Stock of $300,000 and Retained Earnings of $150,000.The book value of Soggi's assets and liabilities were equal to the fair value except for the plant assets.The entire cost-book value differential is allocated to plant assets and is fully depreciated on a straight-line basis over a 10-year period.

During 2011,Puddle borrowed $25,000 on a short-term non-interest-bearing note from Soggi,and on December 31,2011,Puddle mailed a check to Soggi to settle the note.Soggi deposited the check on January 5,2012,but receipt of payment of the note was not reflected in Soggi's December 31,2011 balance sheet.

Required:

Complete the consolidation working papers for the year ended December 31,2011.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Pecan Incorporated acquired 80% of the voting

Q24: On December 31,2010,Patenne Incorporated purchased 60% of

Q25: Pull Incorporated and Shove Company reported summarized

Q26: Pawl Corporation acquired 90% of Snab Corporation

Q27: Parrot Corporation acquired 90% of Swallow Co.on

Q29: Powell Corporation acquired 90% of the voting

Q30: On January 2,2011,PBL Enterprises purchased 90% of

Q31: Pennack Corporation purchased 75% of the outstanding

Q32: On January 2,2011,Paleon Packaging purchased 90% of

Q33: On December 31,2011,Paladium International purchased 70% of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents