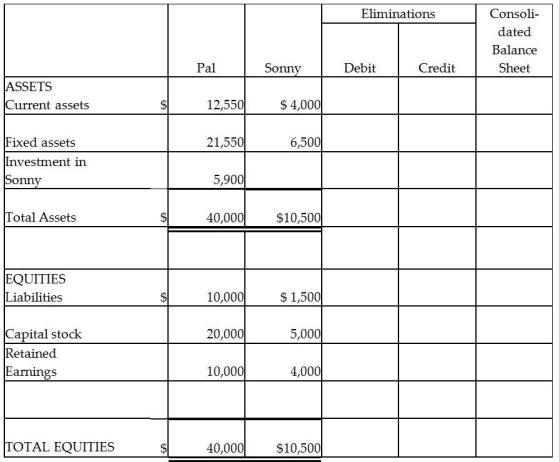

Pal Corporation paid $5,000 for a 60% interest in Sonny Inc.on January 1,2011 when Sonny's stockholders' equity consisted of $5,000 Capital Stock and $2,500 Retained Earnings.The fair value and book value of Sonny's assets and liabilities were equal on this date.Two years later,on December 31,2012,the balance sheets of Pal and Sonny are summarized as follows:

Required:

Required:

Complete the consolidated balance sheet working papers for Pal Corporation and Subsidiary at December 31,2012.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: A subsidiary can be excluded from consolidation

Q14: In the consolidated income statement of Wattlebird

Q18: Pardo Corporation paid $140,000 for a 70%

Q21: On January 1,2005,Myna Corporation issued 10,000 shares

Q22: On January 1,2011,Pinnead Incorporated paid $300,000 for

Q24: On July 1,2011,Polliwog Incorporated paid cash for

Q25: Passerby International purchased 80% of Standaround Company's

Q26: The consolidated balance sheet of Pasker Corporation

Q27: Passcode Incorporated acquired 90% of Safe Systems

Q28: Polaris Incorporated purchased 80% of The Solar

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents